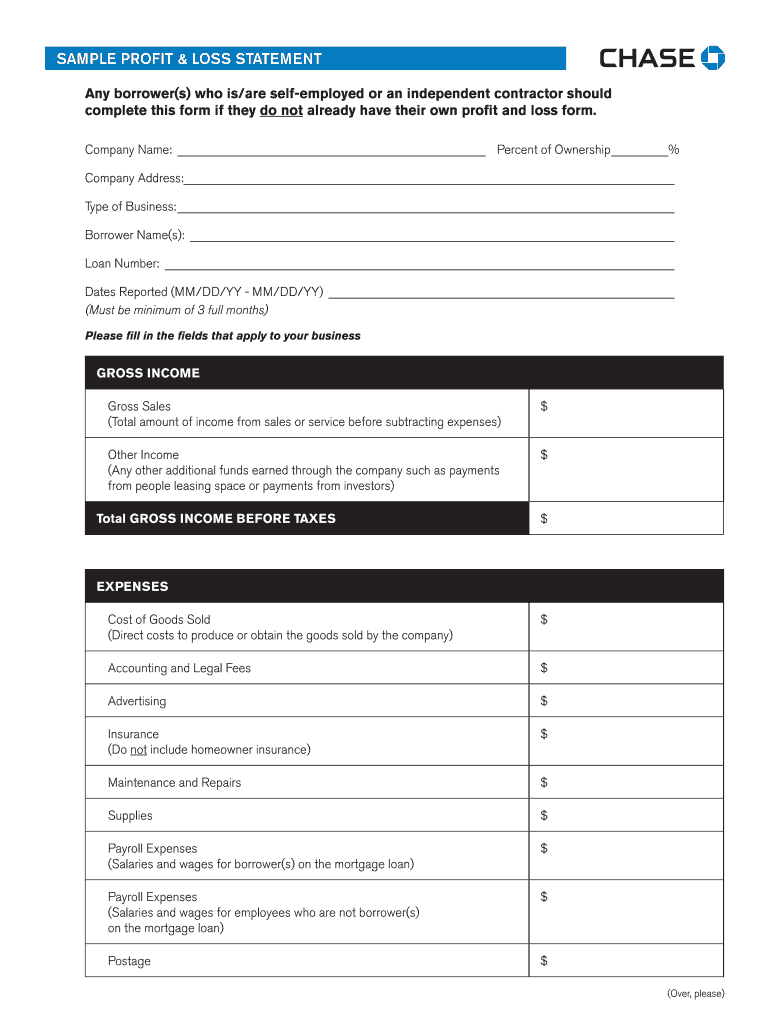

Who needs a Profit and Loss Statement form?

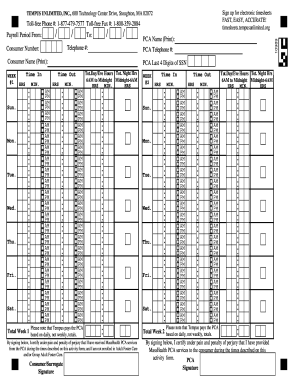

Each borrower working for oneself or being an independent contractor should complete this form to summarize the revenues, costs and expenses they had during a particular period, usually a fiscal quarter or year.

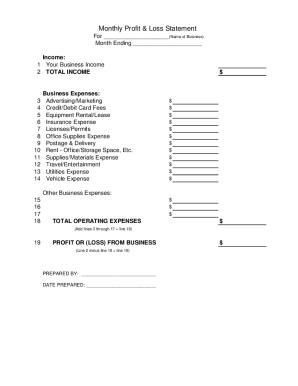

What is the Profit & Loss form for?

The Profit and Loss Statement provides information on total expenditure and revenue, to eventually bring the person’s total net income after taxes. This information can be used by a lender to modify loan terms.

Is the Sample Profit and Loss Statement form accompanied by other forms?

Usually, the Profit and Loss Statement is accompanied by the balance sheet (conclusion, showing what is owned and owed at a given time) and the cash flow statement (showing changes in bills over a selected period).

When is Profit & Loss Statement form due?

The minimum period, which may be reflected in the report is three months. Accordingly, it is intended that this report should be submitted by the borrower once a quarter or less often if it has been previously agreed with the creditor.

How to create a Profit and Loss Statement form?

The borrower should provide accurate information about 1) their company and type of business; 2) their basic information; 3) gross info before taxes; 4) expenses; 5) net income. The document should be signed by the borrower(s).

Where do I send Profit and Loss Statement form?

This document, completed and signed, must be directed to the address of the creditor. However, it is necessary to make sure that the copy of the paper remains with the borrower for their personal needs.